West Palm Beach’s Development Services Department recently held its 2025 Developer Outreach, providing an early look at how the city’s development pipeline is positioned heading into the year. The meeting convened developers, property and business owners, planners, architects, and other industry stakeholders as the city continues to oversee a growing number of projects moving through review, permitting, and construction.

The presentation went beyond key figures, but also outlined how the department is responding to current development demand while offering updates on projects recently delivered, those under construction, and proposals advancing through the approval process. Several upcoming developments were also previewed publicly for the first time, offering insight into what may soon reshape the city’s skyline beyond Downtown. Floridian Development takes a look at the upcoming changes in West Palm Beach.

Completed, Under Construction, or Planned Residential Projects:

Several notable updates were shared regarding the evolution of downtown living and surrounding neighborhoods in 2025. The completion of 512 Clematis added 89 residential units to the downtown core, while Palm Beach Atlantic University’s new dormitory (long the subject of design-related controversy) has moved into the construction phase and is planned to accommodate 990 students.

Under Construction:

- 275 Units: PBA Atlantic Dormitory

- 316 Units: Soleste Palm Station

- 146 Units: Mr C Residences (Not included in the powerpoint but equally as important)

- 479 Units: Olara

- 270 Units: The Spruce

- 381 Units: The District at Northwood

- 55 Units: Alba Residences

- 109 Units: South Flagler House

- 358 Units: 8111 S. Dixie Highway

- 218 Units: One West Palm

- 193 Units: The Berkeley (Not included in the powerpoint but equally as important)

Completed:

- 89 Units: 512 Clematis

- 41 Units: Forte

Planning:

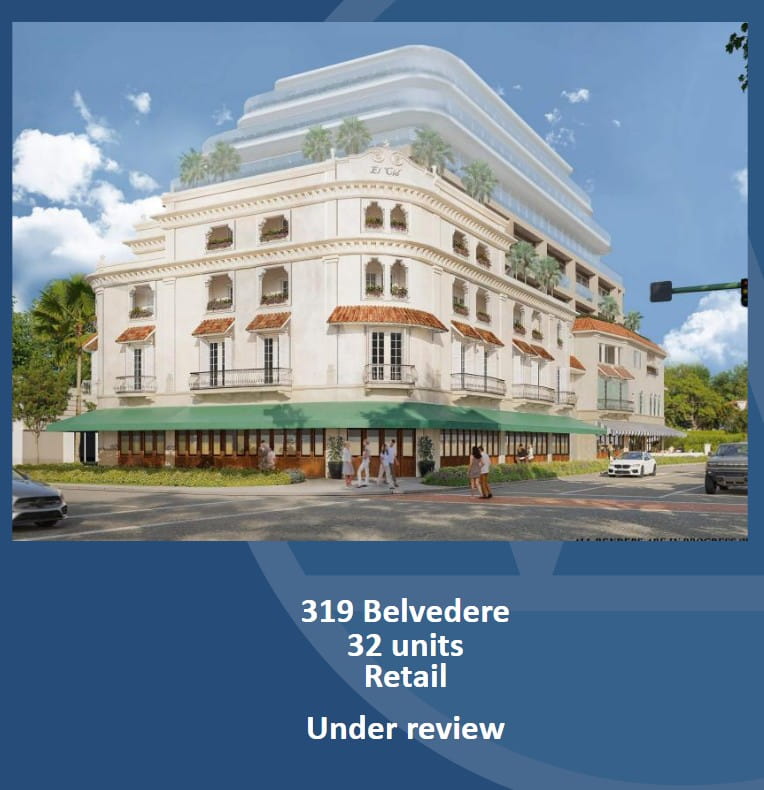

- 32 Units: 319 Belvedere

- 39 Units: Flagler House

- 270 Units: District Point

- 192 Units: 1221 Belvedere

- 320 Units: Alton West Palm

- 97 Units: 5400 N Flagler

- 259 Units: Ryvovich Marina

- 87 Units: Alba Reserve

- 39 Units: Apogee

- 100 Units: Shorecrest

- 152 Units: Jeff Greene (2121 N. Flagler)

- 138 Units: Ritz Carlton

- 80 Units: Parkland Tower

- 367 Units: Pine Street Assemblage (1830 N Dixie)

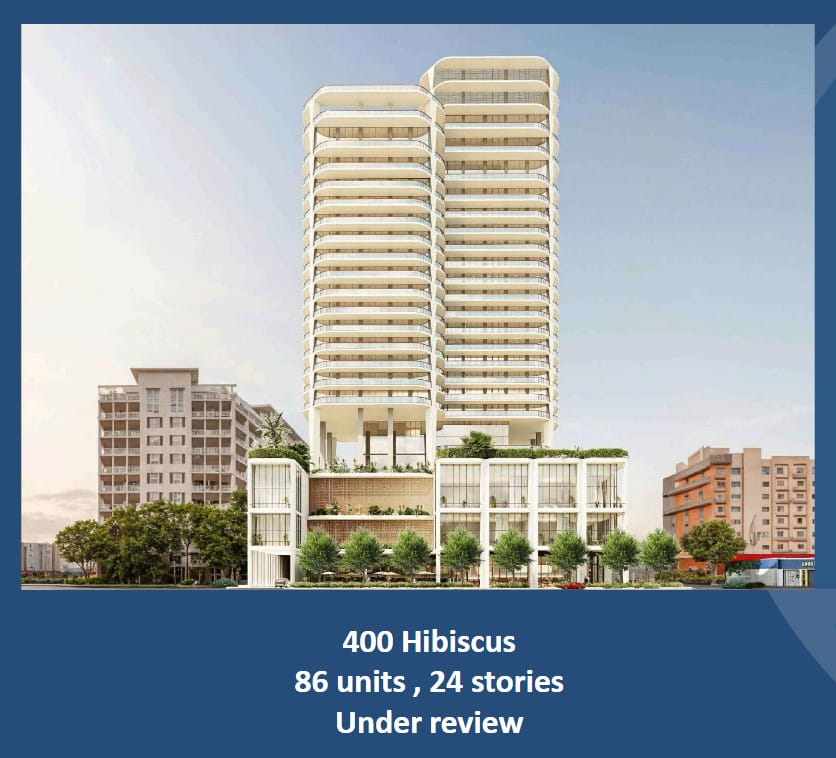

- 86 Units: 400 Hibiscus

- 350 Units: Nora Multifamily

- 122 Units: Nora Condo

- 340 Units: 460 Fern

- 180 Units: Datura Hotel & Residences

- 88 Units: Solana

- 190 Units: 315 S Dixie

- 245 Units: Mercer Park II

- 237 Units: Forum Place

- 190 Units: Family Church

- 1028 Units: Transit Village

- 153 Units: 120 S Dixie Hwy

- 167 Units: Deco Northwood

- 58 Units: Carefree 6 at Flamingo

- 348 Units: Banyan Place

- 159 Units: Clematis Place

- 12 Units: 5179 Broadway Ave

In total, 2,800 multifamily units are currently under construction, with an additional 130 recently completed and 6,125 more under review. Altogether, more than 9,000 units are in the pipeline for West Palm Beach in the coming years, an impressive figure for a city that has only recently begun to accelerate its development pace. (Certain projects may have been excluded due to inadequate data or lack of progress).

Completed, Under Construction, or Planned Hotel Projects:

Hotel development in West Palm Beach are also gaining momentum, fueled by an influx of talent and wealth that has increased both demand and expectations for higher-quality accommodations. Between 2020 and today, the city added 1,641 hotel rooms, including the 215-room property at 695 South Olive which opened in 2022. Looking ahead, the pipeline remains active, with projects such as the planned hotel in the Nora District expected to add 201 rooms and further projects that plan to increase West Palm Beach’s hotel inventory in the coming years.

Under Construction:

- 201 Rooms: NORA Hotel

- 110 Rooms: Mr C. Hotel

- 200 Rooms: One West Palm Hotel

Completed:

- 150 Rooms: The Belgrove Resort & Spa (Completed December, 2024)

Planning:

- 134 Rooms: Viana Hotel

- 420 Rooms: Convention Center II

- 108 Rooms: Transit Village

- 176 Rooms: PBAU Arkona-Olive Hotel

- 233 Rooms: 155 River Grove Way Hotel

- 132 Rooms: Datura Hotel & Residences

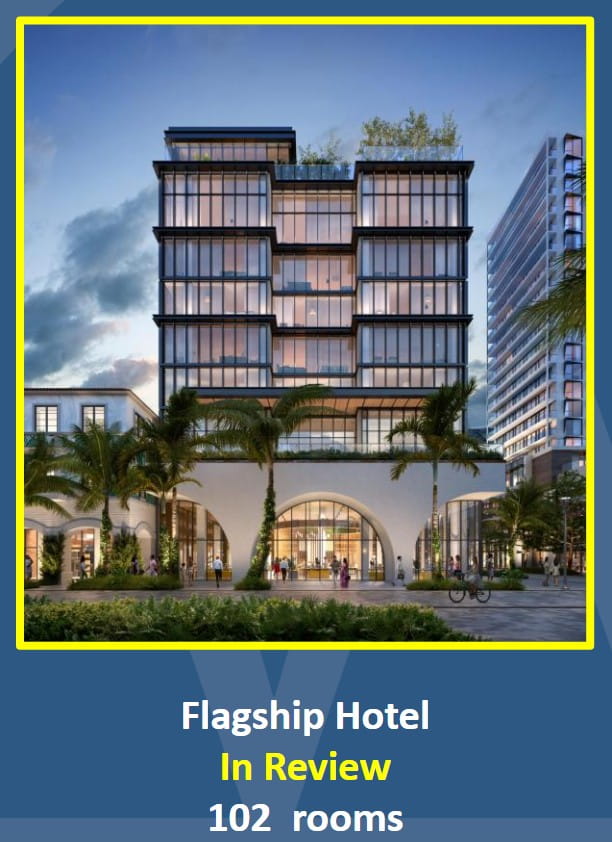

- 102 Rooms: Flagship Hotel

While smaller in scale than the multifamily pipeline, hotel development remains one of West Palm Beach’s most active sectors. Currently, 511 hotel rooms are under construction, with another 150 recently delivered and 1,305 more in various stages of planning. Among the more notable proposals are early plans for the PBAU Arkona–Olive Hotel, which would add a new hotel high-rise near the Palm Beach Atlantic University campus. (Certain projects may have been excluded due to inadequate data or lack of progress).

Completed, Under Construction, or Planned Office Projects:

In the last four years, developers, primarily Related Ross, has added 668,033 SF of new office according to the City of West Palm Beach, representing a large chunk of 1.6m currently of class A office today. The influx of new office construction and proposals in West Palm Beach reflects growing demand for high-quality, Class A space, with strong leasing activity concentrated in the downtown core and sustained interest from major tenants. Office utilization across the market has held above average, and developers such as Related Ross have committed significant capital to new projects.

Under Construction:

- 468,450 SF: West Palm Point

- 480,000: 10 CityPlace

- 181,492 SF: NYU Langone

- 500,000 SF: 15 CityPlace

- 204,067 SF: One West Palm

Completed:

- 270,000 SF: One Flagler

Planning:

- 425,798 SF: 515 Fern Street

- 353,810 SF: 1001 Okeechobee Blvd

- 182,720 SF: Transit Village

- 149,524 SF: The Contemporary

- 38,784 SF: 1221 Belvedere

Perhaps the most closely watched segment of West Palm Beach’s development pipeline, new office construction now represents one of the largest concentrations of planned Class A space in the Southeast. Currently, approximately 1,834,009 SF of office space is under construction, with an additional 270,000 SF recently delivered and another whopping 1,150,636 SF in the planning stages. (Certain projects may have been excluded due to inadequate data or lack of progress).

What Lies in the Future?

As West Palm Beach works to manage an influx of new residents alongside rising construction activity, the city is also advancing several land-use initiatives aimed at making better use of existing urban space. In the Broadway Mixed-Use District, height allowances have been increased from three to seven stories, accompanied by an emphasis on enhanced landscaping and wider sidewalks to improve walkability. At the same time, the city is in the process of updating its Downtown Master Plan, introducing revisions to tower massing and, in select areas, higher height and density limits.

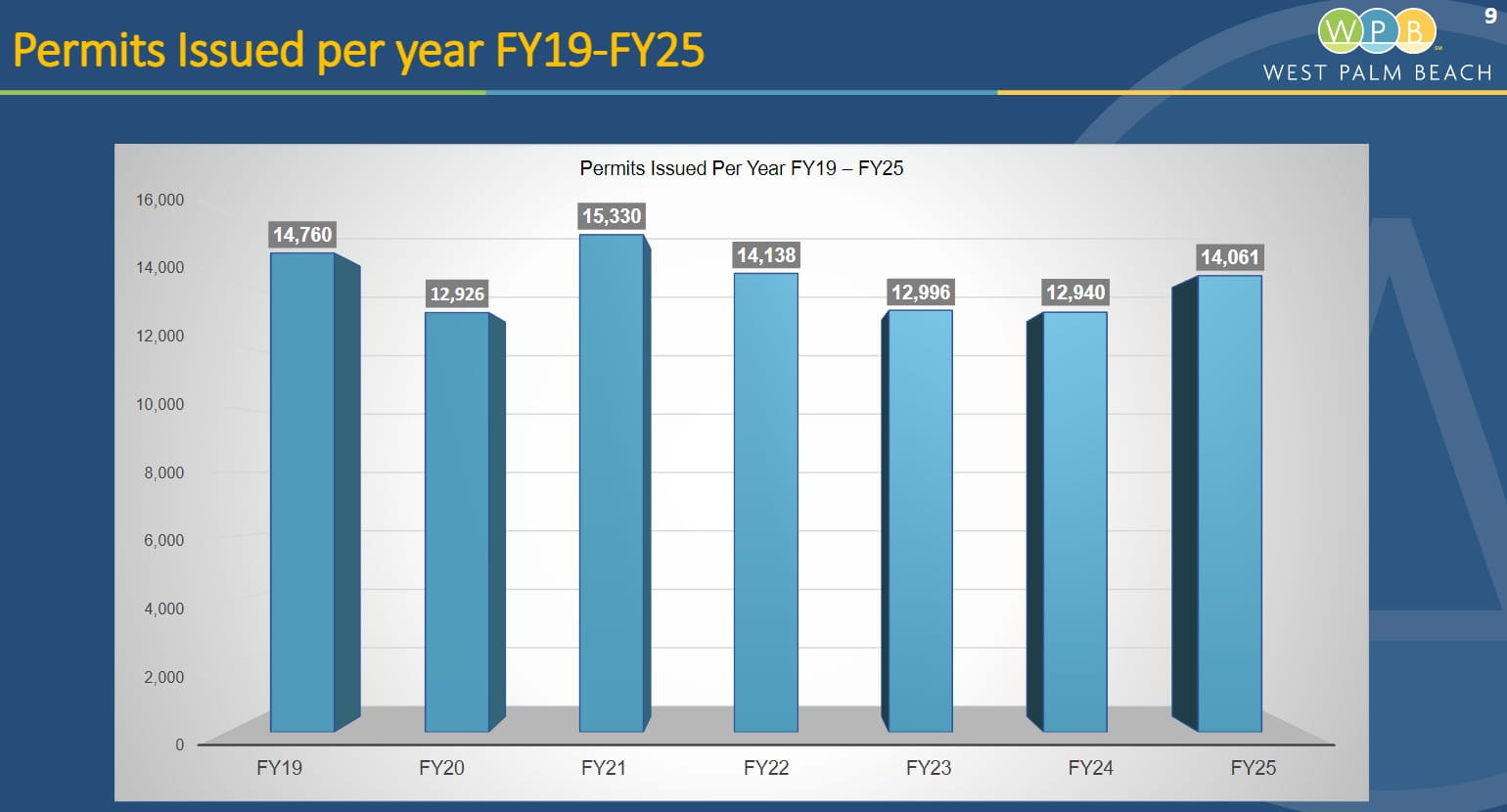

While permitting activity has slowed across much of Florida, West Palm Beach has moved in the opposite direction, reaching its highest level of permit activity since 2022. Of the permits issued, approximately 52 percent are tied to residential construction, with the remaining 48 percent associated with commercial development.

1 Comment

As a WPB resident, it’s great to new residential units being built. Thanks for the recap!